Payments are at the core of every business. A smooth checkout experience keeps customers happy, while disruptions in the buying process can lead to frustration and lost sales. Statistically, up to 40% of cart abandonments happen due to payment failures!

This is why businesses are increasingly adopting payment orchestration platforms, which bring efficiency, flexibility, and reliability to payment processing.

So, what exactly is a payment orchestration platform, and how is it different from a standard payment gateway? Let’s break it down.

What is a payment orchestration platform?

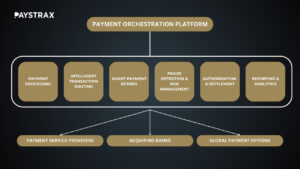

A payment orchestration platform is an advanced payment management system. Instead of relying on a single gateway, it dynamically routes transactions to the best option based on cost, location, and success rates. This ensures speed, security, and efficiency as well as reducing failed payments.

With multi-PSP connectivity, payment orchestration platform enables multiple payment gateways integration without separate contracts, making it easier to switch providers, expand globally, and support various payment methods. The platform also includes fraud detection and risk management, monitoring transactions in real time to prevent fraud and chargebacks while upholding KYC, AML, and PSD2 regulations.

A unified reporting dashboard consolidates payment data across all providers, simplifying financial tracking and reconciliation. By automating routing, security, and compliance, a payment orchestration platform streamlines payments, reducing operational complexity and improving transaction success rates.

In short, a Payment Orchestration platform does all the hard work, so businesses or customers don’t have to worry about it.

Payment gateway vs. payment orchestration platform

Many businesses still rely on traditional payment gateways, which are useful but limited. It’s easy to confuse a payment gateway with a payment orchestration platform because they both handle transactions. But they’re not the same.

A payment gateway processes payments from customers and routes them to a designated merchant bank or payment processor. It’s a direct line between the buyer and the financial institution. However, if that gateway fails or doesn’t support certain payment methods, the transaction is declined.

A payment orchestration platform, on the other hand, connects to multiple gateways and processors, dynamically selecting the best option for each transaction. If one gateway is down, the orchestration platform reroutes the payment to another, ensuring smooth payment and fewer failed transactions.

Here’s how traditional gateways compare to payment orchestration platform:

| Feature | Payment Gateway | Payment orchestration platform |

| Supports multiple payment providers | No | Yes |

| Optimises transaction routing | No | Yes |

| Reduces payment failures | No | Yes |

| Adapts to different global markets | Limited | Fully flexible |

| Enhances fraud prevention | Basic tools | Advanced tools |

| Reduces processing costs | Limited | Smart cost reduction |

How a payment orchestration platform benefits the end-users

After establishing what a payment orchestration platform does, let’s talk about why it matters.

| Benefit | For Business | For Customer |

| Fewer failed payments | Payment orchestration platform automatically reroutes failed transactions, offering alternative payment methods, and adapting to customer preferences. This means fewer customers leaving the website empty-handed. | No more frustration because of declined transactions without explanation. If one payment method doesn’t work, the system offers an alternative in real time, making sure the checkout process is smooth, resulting in a better user experience. |

| Smarter cost savings | Processing fees can add up fast. With payment orchestration platform, businesses can route transactions through the most cost-effective PSPs, reducing unnecessary fees and maximising profits. | Customers may see lower or no extra fees when checking out. |

| Convenience | Different countries have different payment preferences. A payment orchestration platform enables businesses to accept multiple payment types, including cards, bank transfers, e-wallets, and even cryptocurrency. | Customers can pay using their preferred method, no matter where they are. The checkout process feels familiar and convenient. |

| Less technical headache | One integration replaces the need for multiple contracts and APIs, making it easier to scale and adapt to new markets without a complex payment setup. | Customers don’t experience technical issues like failed redirects or broken payment pages, leading to a more reliable shopping experience. |

| Better fraud prevention | A payment orchestration platform integrates fraud detection, KYC, and AML procedures, ensuring transactions are secure while keeping businesses compliant with global regulations. This helps minimise chargebacks and suspicious activity. | Customers benefit from added security layers that protect their personal and financial information, reducing the risk of fraud and identity theft. |

To sum it up, a payment orchestration platform makes life easier and creates a win-win situation for both businesses and customers.

PAYSTRAX’s payment orchestration platform

PAYSTRAX provides a robust payment orchestration platform that centralises and streamlines every aspect of payment processing.

With PAYSTRAX, businesses can:

✅ Access a wide range of payment methods across global markets, all through a single integration.

✅ Handle payment authentication, multi-PSP transaction routing, and settlement with ease.

✅ Benefit from built-in compliance tools, including KYC and AML procedures.

✅ Reduce fraud and chargebacks through advanced risk management and real-time transaction monitoring.

✅ Connect to multiple payment gateways like ACI and Cardstream, with additional services tailored to business needs.

✅ Get fast onboarding and a constant support from over 100 PAYSTRAX specialists, ready to help anytime.

Want to learn more about how PAYSTRAX’s payment orchestration platform can help your business? Get in touch with us today!