Ever sent money to someone in Europe and wondered why it arrived so quickly? That’s SEPA in action. If you have ever made a euro payment within the region, chances are you’ve already used SEPA transfer without realising it.

What is SEPA?

SEPA stands for the Single Euro Payments Area. It‘s a system that allows people and businesses to make euro transfers quickly, safely, and at low cost within participating countries.

As of 2025, SEPA includes 38 countries. Most of them use euro as their main currency, but some, like Norway and the UK, do not. However, they still support SEPA transfers in euros.

What is a SEPA Transfer?

A SEPA transfer is a euro payment sent between banks in SEPA countries. It uses a standardised system, meaning all transactions follow the same rules, whether you’re sending money to Spain or to your friend in Germany.

All you need is the recipient’s International Bank Account Number (IBAN). No SWIFT codes, no middlemen, no nothing – the process is very smooth and easy.

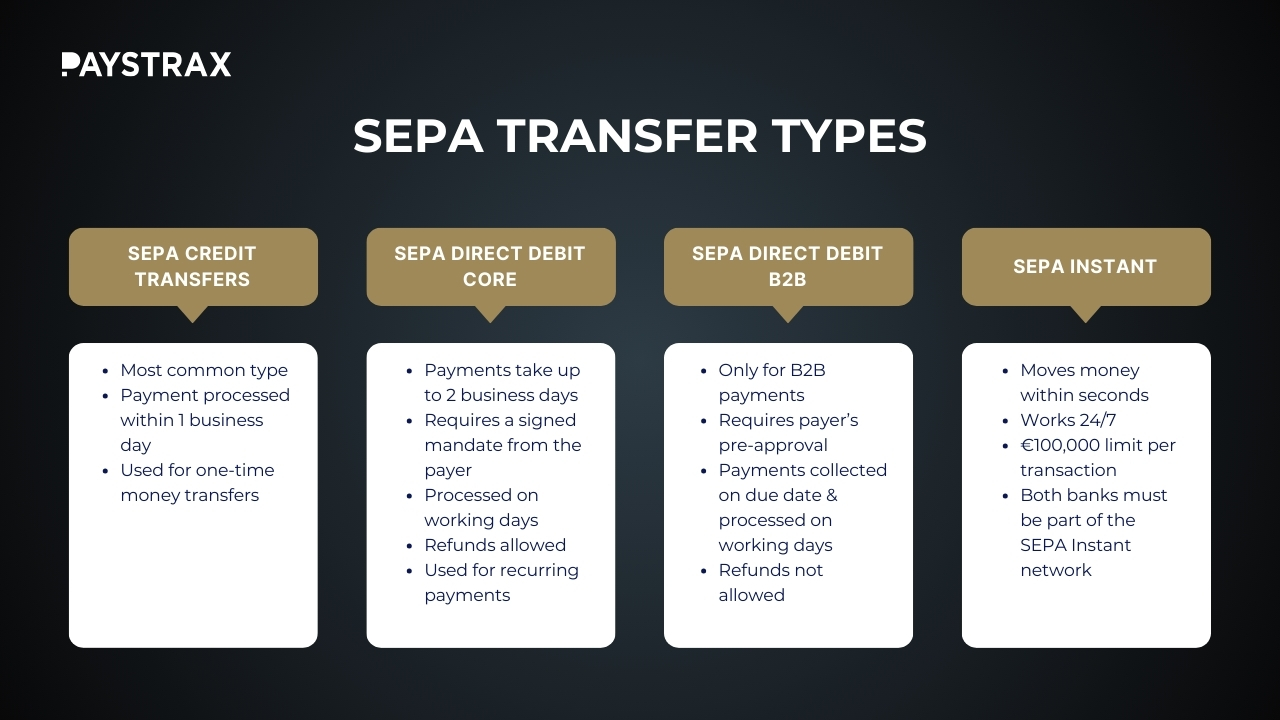

SEPA transfers can come in different types:

SEPA Credit Transfer: the most common type, usually processed within one business day. It‘s used for one-time payments between individuals, businesses, and government entities. Processing usually takes 1 business day. Commonly used for payroll, supplier payments, and invoices.

SEPA Direct Debit Core: used for recurring payments like subscriptions, rent, and utilities. Payments take up to 2 business days, require a signed mandate from the payer, and are only processed on working days. It’s widely used by individuals and businesses to automate payments.

SEPA Direct Debit B2B: exclusively for business-to-business payments, requiring the payer’s explicit pre-approval. Unlike SEPA Direct Debit Core, refunds are not allowed. Payments are typically collected on the due date and processed only on working days. It’s ideal for supplier agreements and leasing fees.

SEPA Instant: a newer system that moves money within seconds, 24/7 (yes, including weekends!). The limit per transaction is €100,000, and both banks must be part of the SEPA Instant network. Popular for e-commerce, emergency transfers, and fast B2B settlements. The number of banks joining the SEPA Instant network is continuously increasing. Currently 23 countries already support real-time SEPA transfers.

Why SEPA Transfer is so popular?

SEPA transfers are widely used because they:

✅ Make cross-border payments as simple as domestic ones

✅ Lower transaction costs compared to international wire transfers

✅ Ensure quick processing times

✅ Follow strict security regulations and reduce fraud risk

✅ Improve cash flow and make it easier to operate across Europe (exclusively for businesses)

If you’d like to learn more about SEPA payments or how to enable them for your business, feel free to contact us.