On April 1, 2025, Visa will introduce a new Visa Acquirer Monitoring Program (VAMP). While the primary changes impact payment processors, online merchants will also face important updates. To help you stay ahead, let’s explore how these changes will affect your business and what you can do to prepare.

VAMP’s impact on e-commerce

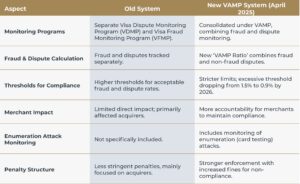

The introduction of the Visa Acquirer Monitoring Program (VAMP) marks a significant shift in how fraud and disputes are monitored in e-commerce and digital transactions. By consolidating existing fraud and dispute monitoring programs into a unified system, VAMP aims to create stricter oversight for payment processors while indirectly holding merchants to higher standards.

With the introduction of the VAMP ratio, online businesses will need to adopt stronger fraud prevention strategies to maintain compliance. This means merchants will have to closely monitor chargeback rates, implement advanced fraud detection tools, and enhance their customer dispute resolution processes.

Additionally, the inclusion of enumeration attack monitoring – which detects unauthorised attempts to test payment card details – places further emphasis on security, urging merchants to reinforce their payment gateways against fraudulent activities. These changes will ultimately push the digital commerce ecosystem toward greater transparency, lower fraud rates, and improved consumer trust.

Here’s a summary table comparing the differences between the old system and the new Visa Acquirer Monitoring Program (VAMP):

Updated VAMP Thresholds

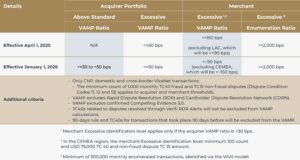

Visa’s lifecycle management approach in the Visa Acquirer Monitoring Program (VAMP) helps detect and address fraud, disputes, and enumeration activity before they escalate. Each month, Visa reviews card-not-present transactions (TC05), processed disputes (TC15), reported fraud (TC40), and enumeration activity, assessing whether acquirers and their merchants remain within acceptable thresholds. Starting April 1, 2025, TC40s related to disputes resolved through Verifi’s RDR Alerts will still be counted toward VAMP calculations and will no longer be excluded.

Acquirers and merchants exceeding these limits fall into two categories:

Above Standard Level: Indicates rising fraud, disputes, or enumeration activity above market norms. Acquirers must take remedial action to return to compliance, with Visa monitoring at the acquirer portfolio level.

Excessive Level: Signals critical fraud and dispute levels, requiring strict corrective measures. Visa monitors both at the acquirer portfolio and individual merchant levels, grouping merchants where necessary.

The new VAMP program introduces lower thresholds:

What happens if you don’t comply?

Failure to comply with the new VAMP criteria can result in fines for both acquirers and merchants, depending on the severity of fraud and dispute levels. Visa’s goal is to encourage businesses to take accountability and implement proactive measures to reduce fraud and dispute ratios.

Acquirers identified as Above Standard or Excessive will receive a three-month grace period to improve their performance. After this period, if an acquirer remains noncompliant with VAMP for 3 or more consecutive months, Visa may impose additional enforcement measures, including Risk Reduction Conditions, in addition to fines.

If an acquirer’s portfolio exceeds the specified threshold, fines will be applied to each non-fraud dispute and TC 40 report for all merchants with a VAMP ratio of ≥ 30 bps. For merchants exceeding the threshold, fines will apply to each non-fraud dispute and TC 40 for that merchant only.

Additionally, in Asia-Pacific (AP) and Europe, if an unsecured dispute fee is applied, the VAMP fine will not be imposed. These penalties are avoidable, and Visa encourages businesses to take the necessary steps to maintain compliance and enhance payment security.

As of now, the expected fines are as follows:

Advisory period from April 1 to September 30, 2025

From April 1 to September 30, 2025, Visa will implement an advisory period for VAMP. During this time, businesses exceeding the new fraud and dispute thresholds will receive notifications and guidance rather than immediate penalties. This period allows merchants and acquirers to adjust their fraud prevention strategies and dispute management processes to comply with the updated requirements before enforcement begins.

While no fines will be issued during the advisory period, businesses should actively monitor their VAMP ratios on MID level, implement corrective measures, and work with their acquirers to reduce fraud risks. After September 30, 2025, Visa will begin enforcing penalties for non-compliance, making it crucial for merchants to use this transition period effectively.

For merchants of PAYSTRAX

As an acquirer, PAYSTRAX is already taking proactive steps to ensure full compliance with the upcoming Visa Acquirer Monitoring Program (VAMP). Recognising the importance of fraud prevention and dispute management, we have partnered with DisputeHelp to provide our merchants with advanced chargeback management tools. Through this and other collaborations, we are implementing a range of solutions designed to enhance security, reduce dispute ratios, and improve overall payment processing efficiency. Our goal is to help merchants navigate these regulatory changes seamlessly while minimising financial risks and maintaining compliance with Visa’s evolving standards.