Online payment gateway

The feature-rich payment processing system for online payment acceptance.

Get started

Customised eCommerce payment solutions for business growth

Explore freedom and autonomy to quickly adjust your payments strategy in real time as markets develop, and opportunities arise. Provide seamless customer experience, offering convenient card and alternative payment methods for your online customers. Expand your markets with possibilities to accept local and foreign currencies from shoppers all over the world.

Innovative technological solutions for online business

A constantly evolving payment system quickly adapts to every business need. Optimised and automated payment orchestration ensures smooth business growth.

Integrated fraud prevention tools and real-time transaction checks.

Analyse the payment data and identify patterns to improve your marketing strategies.

Mobile SDK integration for user-friendly payment experience on your app.

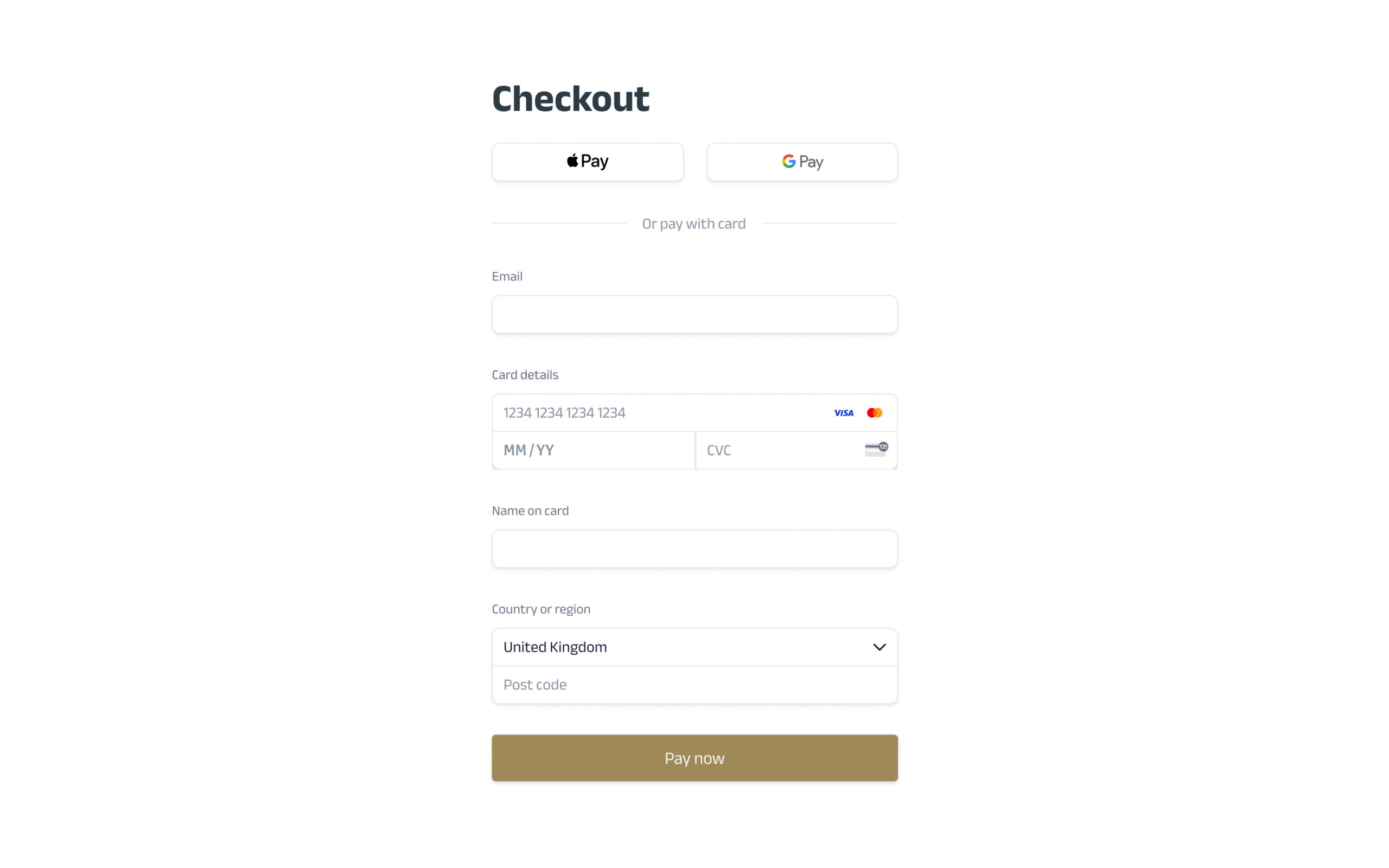

How the payments are processed through our payment gateway

Payment start

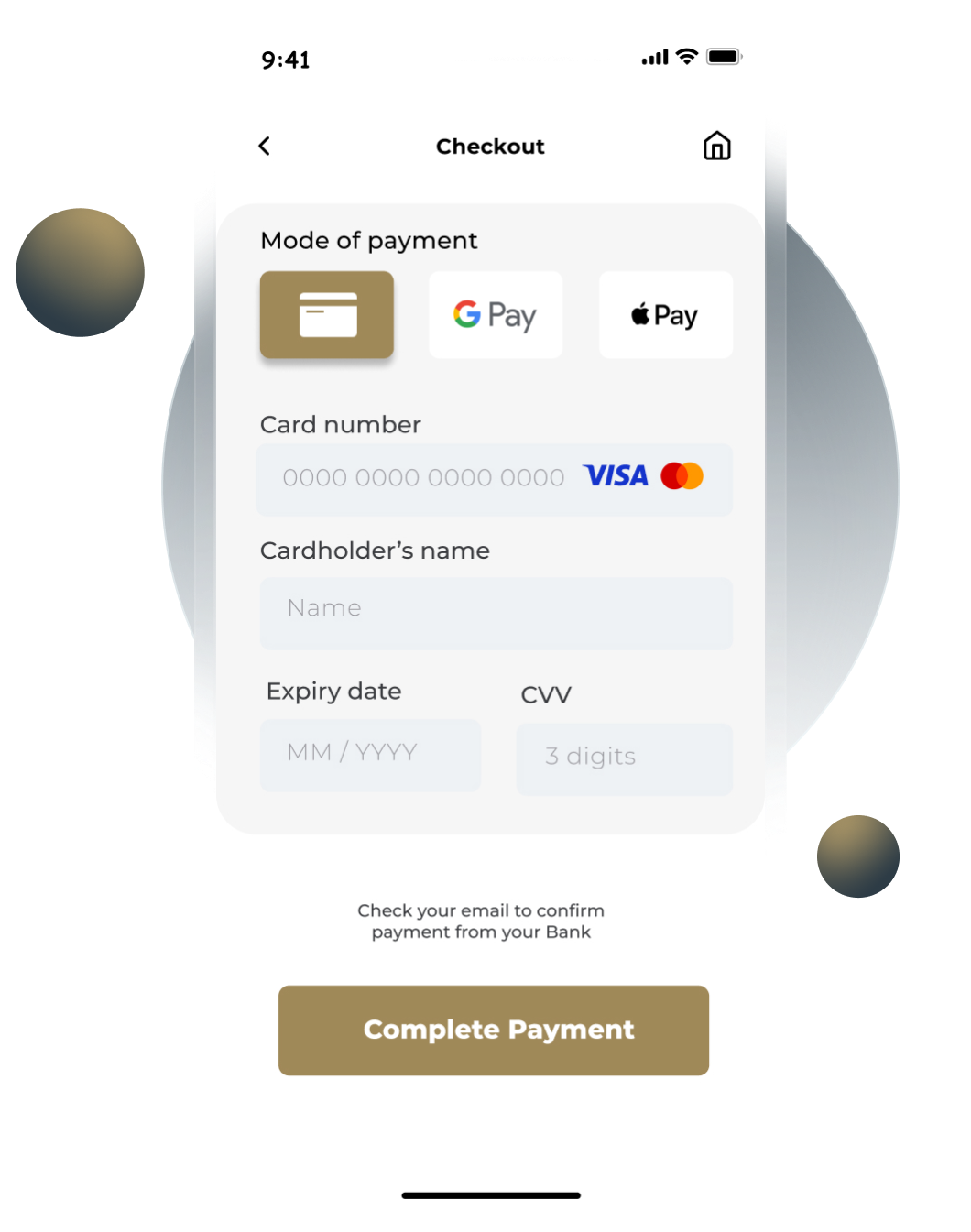

The customer initiates a purchase on a website or app and selects the preferred payment method. The customer enters their payment information, such as credit card details or other payment methods, securely on the website or app checkout.

Encryption and transmission

The payment details are encrypted to ensure security. Encrypted information is transmitted to the payment gateway.

Authorisation

The payment gateway forwards the encrypted information to the relevant financial institution (bank or credit card company) for authorisation.

Payment successful

Upon approval, the payment gateway sends a confirmation to the website or app, and the transaction is completed. The customer receives a confirmation of the successful payment.

Maintain your brand consistency throughout the entire purchasing journey

Flexibly adapt to specific business requirements and models. Whether it's subscription-based services, digital products, or physical goods, a tailored checkout can accommodate diverse business needs.

Enhanced user experience

User-friendly design and functions, leading to higher customer satisfaction and increased chances of completing a purchase.

Mobile optimisation

A mobile-friendly checkout provides a more positive experience to customers using smartphones and tablets.

Payment orchestration

Our advanced payment gateway goes beyond traditional solutions, offering a comprehensive set of features, including payment orchestration. With payment orchestration, we bring a new level of efficiency to the transaction process by intelligently managing and optimising payment flows.

KEY FEATURES

Ready for set-up, integration and customisation

Omni-channel

Our omni-channel solution gives your customers a frictionless checkout experience, using the same core engine for all channels and geographies.

Global coverage

Instant global coverage almost anywhere in the world, with multiple language support.

Easy integration

We offer payment widget and server-to-server integration for easier and quicker set-up possibilities.

Payment processing

Feature-rich payment processing capabilities that are rapidly adaptable to any market and any business need.

Business intelligence

Intuitive business intelligence portal with a user-friendly interface for monitoring and identifying trends.

Integral risk checks

Fully PCI-compliant, with integral risk checks to secure payments and increase security.

Quick onboarding

Feature-rich onboarding process reduces set-up time to get your business up and running quickly.

Automation

Integrated machine learning and artificial intelligence (AI) for better fraud prevention and data analysis.

Omni-channel

Our omni-channel solution gives your customers a frictionless checkout experience, using the same core engine for all channels and geographies.

Global coverage

Instant global coverage almost anywhere in the world, with multiple language support.

Easy integration

We offer payment widget and server-to-server integration for easier and quicker set-up possibilities.

Payment processing

Feature-rich payment processing capabilities that are rapidly adaptable to any market and any business need.

Business intelligence

Intuitive business intelligence portal with a user-friendly interface for monitoring and identifying trends.

Integral risk checks

Fully PCI-compliant, with integral risk checks to secure payments and increase security.

Quick onboarding

Feature-rich onboarding process reduces set-up time to get your business up and running quickly.

Automation

Integrated machine learning and artificial intelligence (AI) for better fraud prevention and data analysis.

Frequently asked questions

What is a payment gateway?

A payment gateway is a technology platform that enables businesses to securely accept and process payments from customers, acting as a bridge between the merchant and financial institutions. It encrypts and transmits payment information, conducts fraud checks, and facilitates various payment methods.

How does a payment gateway work?

When a customer presses “buy” or inserts their card into a POS terminal, they are taken to a payment gateway (checkout). During those few processing seconds, the payment gateway conducts various risk checks and the acquirer is connected to the bank that issued the card, requesting transaction approval. The transaction is either approved or denied and the money from the customer is placed in the acquirer’s funds that are released later.

What e-Commerce platforms does the payment gateway support?

Our payment gateway supports various e-Commerce platforms: WooCommerce, OpenCart, Shopify, PrestaShop, Magento, WP eCommerce, JigoShop, Drupal, xt:Commerce, Gambio, Modified, Commerce:SEO, MijoShop, AceShop, Oxid Esales, SEO Mercari, JTL Shop, Shopware.

How does risk management of the transactions work?

Each transaction is checked with AI tools set up in the system. If a transaction is detected as possible fraud, it is checked again by our security team. You can find more about risk and fraud management here.

What payment methods are accepted through the gateway?

With our online payment gateway you can accept Visa and Mastercard cards and their alternatives, such as Google Pay and Apple Pay.

How quickly can merchants access funds after a successful transaction?

Each settlement date is discussed and decided with the merchant individually. Settlements can be transferred daily or weekly..

Can’t find answer to your question?

Contact usExplore related key features

Risk & fraud management

Fully PCI DSS-compliant services and a multi-layered fraud prevention technology, backed by a team of risk experts. This minimises risk and saves you money by delivering visibility across all channels.

Read moreMulti-currency payment acceptance

Perform authorisations and settle transactions in the world’s most popular currencies. Get a new source of revenue from cross-border cardholders who visit your site.

Read moreIntegration

Simple payment gateway set-up and integration. Choose from different integration methods to suit your requirements and start accepting payments in no time.

Read more